Predictions for 2015

Speaking on the coming year, a total of 81% of fabricators said they expected sales revenue to increase. Another 16% said it would remain the same, and only 3% anticipate a decline in sales in 2015. On average, the fabricators who expect an increase see their sales growing by 17%.

One of the factors attributed to the positive market perception is the improvement in the economy. “There is confidence in the economy and real estate,” stated one fabricator. While another believes there is more consumer spending and disposable income now than in the past.

Additionally, the rebounding housing market and rise in new construction/remodeling are other reasons for the positive market forecast. “I feel an energy in the marketplace where homeowners are ready to continue making their lives better, and home remodeling is a part of that,” stated one fabricator. “Building in the area is still on a great upswing, and recognition of the value of the use of stone only continues to grow as well,” said another, adding that orders for next year are already being placed ahead of normal schedule.

Additionally, one fabricator cited the Internet for opening “doors” and leading to increased sales, while another said that a ramp up in the company’s marketing efforts has led to an expanded client base.

Long-term confidence

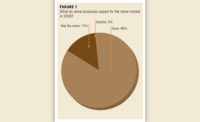

The fabricators who participated in the Stone World survey expressed even greater confidence over the next five to 10 years. A total of 89% of those polled believe that sales will increase over this period. This is up 6% from the 2013 survey. The average sales revenue growth in the next five to 10 years is expected to be 24%. It was very close between those fabricators who predict sales in the next five to 10 years to remain the same (6%) or decline (5%).

When asked about the reasons for long-term optimism, many fabricators again attributed it to an improving housing market in combination with a better economy. “I think oil prices will stay low, and the economy will benefit and grow,” stated a fabricator.

Many factors also believe another reason for continual growth is because consumers are more educated than ever and there is a heightened demand for natural stone. “Customers are beginning to see the value in investment in natural stone, and they are veering away from man-made options,” said one fabricator. “There is an increased market share based on consumer sophistication and awareness of stone products,” stated another.

Several fabricators stated a drop in price point of stone products has led to more buying. “More people can afford stone as technology brings the cost down,” said a fabricator. “As granite becomes more popular and available, the price for granite slabs should drop — making it more comparable to cheaper countertop materials,” stated another.

Investments planned for 2015

Judging by the survey results, equipment purchases will be on the rise in 2015, with 68% of respondents planning to invest. The purchases will range from CNC stoneworking centers (28%) to digital/electronic templating (19%) and hand tools, which continue to be the most popular purchase (52%). Statistics show the average spending on hand tools in 2015 is expected to be $8,142, while responding companies anticipate investing $199,000 in CNC stoneworking centers. Moreover, safety remains a top priority in many shops, with 37% of the fabricators polled planning to invest in material handling and transportation equipment — spending a mean of $29,056. A total of 15% will be investing in air/water treatment systems.

Personnel is expected to be an investment focus for the coming year (46%) — up from 34% in 2014. Additional areas of investment include marketing (37%), stock (27%), and improving their showrooms and facilities (both 23%).

Looking back at 2014

In addition to various factors already given for optimism in 2015, many fabricators also cited their success in 2014. The Stone World survey asked fabricators to compare their business levels from 2013 to 2014.

According to the survey, 72% of fabricators watched their business grow during 2014. It was a tie for those who reported sales remained the same and those who saw a decline at 14% each. In 2013, 21% reported that business held steady and 11% said it had declined.

Participants in the Stone World survey who reported gross annual sales of more than $1 million remain consistent with last year’s results at 62%. This broke down as 41% selling between $1 million and $3 million, 10% between $3 million and $5 million, and 11% selling more than $5 million.

When asked to compare overall industry business conditions today to those of a year ago, 65% said that conditions had improved, while 27% said they remained stable and 9% said they were worse.

Similar to 2013, about half of the respondents indicated that increased competition has no impact on their business, while 41 to 42% feel a negative impact. Competition from low-end fabricators remains the greatest challenge for many fabricators (49%), while 37% cite smaller margins on current products and services as their biggest difficulty.

The percentage of fabrication shops processing both natural stone and quartz surfacing has remained consistent for the last three years at 78% in 2014, 79% in 2013 and 76% in 2012.

Of those responding to the Stone World fabricator survey, 20% have five employees or less, 55% have a staff of six to 20 employees, 18% have 21 to 50 employees and only 7% have more than 50. The majority of those polled (42%) have been in business between 11 and 20 years.